The U.S. Treasury market experienced a significant decline as investors reacted to signals of upcoming Trump tariffs, adding new volatility to global financial markets. The latest drop in Treasury bond prices reflects increasing concerns over potential trade restrictions and their broader economic implications.

Treasury Yields Rise Amid Tariff Concerns

The yield on the benchmark 10-year Treasury note climbed in response to speculation over former President Donald Trump’s proposed tariffs. Historically considered a safe-haven asset, Treasuries saw a sell-off as traders assessed the impact of potential trade barriers on inflation and Federal Reserve policy.

The rise in Treasury yields signals a shift in investor sentiment, as heightened protectionist policies could lead to supply chain disruptions, increased production costs, and rising consumer prices. This shift challenges previous expectations of stable economic growth, prompting adjustments in both bond and equity markets.

Trump’s Trade Policy and Market Reactions

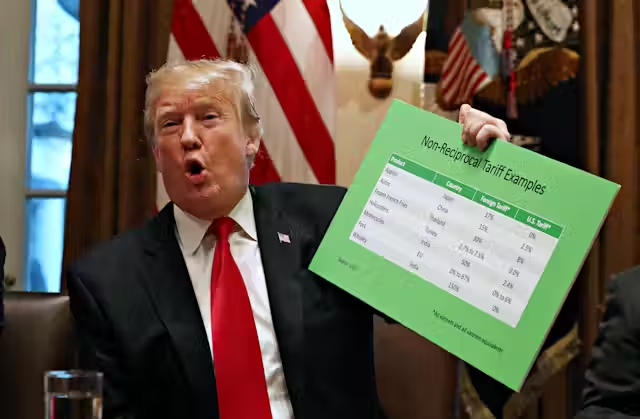

Trump has long advocated for tariffs as a means of protecting domestic industries and addressing trade imbalances. With speculation growing about a renewed tariff strategy in April, market participants are bracing for economic consequences, particularly regarding inflationary pressures and Fed rate adjustments.

Wall Street analysts suggest that if Trump tariffs are reintroduced, the Federal Reserve may need to reconsider its monetary policy approach. The potential for higher import costs and subsequent inflation could deter the Fed from cutting interest rates, keeping borrowing costs elevated.

Stock Market and Global Implications

The stock market also responded to Trump tariff concerns, with equity indices experiencing fluctuations amid uncertainty. Investors are weighing the risks of potential retaliation from key trading partners such as China and the European Union. Historically, trade wars have led to volatility in global markets, impacting corporate earnings and economic growth projections.

In addition to U.S. markets, global bond markets are feeling the effects. The yield on German bunds and UK gilts edged higher, reflecting a broader risk-off sentiment among international investors.

What’s Next for Investors?

Financial experts advise keeping a close eye on developments related to Trump tariffs, as further announcements could drive additional market movements. Bond investors, in particular, may need to adjust their strategies based on evolving trade policies and potential Federal Reserve responses.

While the uncertainty surrounding tariffs introduces new risks, some analysts see opportunities in certain fixed-income assets, such as inflation-protected securities and corporate bonds with strong credit ratings. The coming months will be crucial in determining the long-term impact of trade policy on the U.S. economy and global financial stability.

As the debate over Trump tariffs intensifies, market participants will continue to assess their implications on inflation, interest rates, and economic growth, shaping investment strategies in an increasingly complex financial landscape.